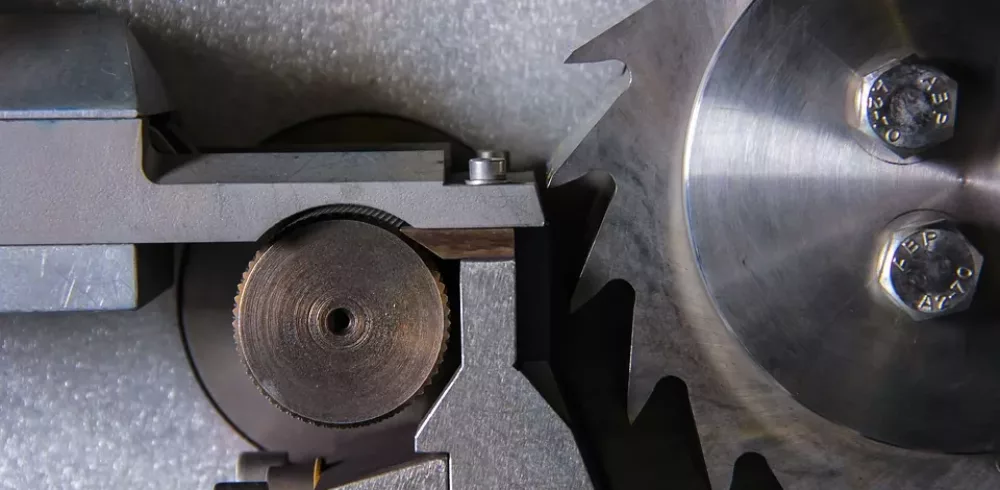

Out of all sectors of industry, manufacturing companies face some of the highest capital overheads. Modern manufacturing, processing and precision engineering companies simply cannot function without specialist equipment and machinery, whether that is to automate processes, handle heavy or dangerous materials, or maximise efficiency and output.

In an ideal world, businesses would always turnover enough to have ready cash available when a piece of machinery needed replacing or upgrading. But this is not how things are. When margins are tight, cash flow can be unforgiving of the need to make large capital purchases. And the more specialised or high tech the equipment is, the higher the outlay required.

However, when it comes to adding, replacing or updating machinery, manufacturing businesses have little choice. It is either make the investment or cease operating. That is why, regardless or cash flow or capital reserves, manufacturers have to be able to acquire new machinery. That is why asset finance is so important in the manufacturing industry.

Finance is often the only way manufacturing companies can procure the heavy machinery and equipment they depend on. It allows costs to be spread out over longer periods, meaning outlay can be structured to fit in with the confines of available cash flow, and reducing the risks of large up front expenditure.

The downside is that you pay interest on the repayments, so TCO is raised. But better this than not be able to acquire the equipment at all.

The key question most manufacturing businesses face is, which type of asset finance should we choose? There are two broad types, hire purchase and leasing. Which you opt for will largely depend on your companyâs circumstances, the type of machinery you wish to acquire, and its value.

Hire Purchase

Hire purchase spreads the cost of buying equipment over a fixed term repayment period. The financing company effectively purchases the asset, and then allows the client to use it on a hire basis while they pay off the purchase value in installments, with interest added. Once the repayment period has come to an end, ownership passes to the client.

The benefits of hire purchase is that it spreads the upfront costs of buying equipment. Repayment terms are often flexible so they can fit in with the requirements of your businessesâ cash flow, they are predictable and stable so you can budget around the costs, and in the end you own the equipment yourself.

Leasing

Leasing finance works in much the same way as hire purchase – the finance provider buys the equipment up front, and then gives it to the client on a rental basis in return for pre-agreed payments. The key difference is that, with leasing, there is no automatic provision for the client to own the equipment come the end of the payment term.

There are actually two types of finance leasing:

- Operational lease, which is leasing in its traditional sense – the client rents the equipment only, and on completion of the lease term, it returns to the finance provider.

- Finance lease. This keeps more options open for the client. At the end of the leasing period, they can choose whether to return the equipment or pay off the balance of the assetâs purchase cost – known as a âballoon paymentâ – to buy it outright.

The choice between leasing and hire purchase can come down to a variety of factors. If the equipment is only likely to be used for a relatively short period, say a couple of years, then leasing often makes sense. This is especially true if the value of the asset is likely to depreciate considerably in that time, reducing the amount you could recoup through resale. Leasing also has tax benefits, as lease repayments can be tax deductible.

However, in other circumstances, it is important to have an asset on your own balance sheet, which it can only do if you purchase it. As owner, you are also free to use it and alter it as you like, and if its is damaged or in need of repair, you will not have to pay the same premiums you do under leasing arrangements.

Finally, flexibility if often the key. If you are not sure what the effective operational life of a piece of equipment will be, how its value will depreciate, or simply want to delay a decision about ownership, a finance lease means you can still use the asset while you make those decisions.

Find out more

Peregrine Leasing is one of the UKâs leading providers of asset finance, with more than 25 yearsâ experience in the manufacturing industry. Visit www.peregrineleasing.co.uk to find out more.

Manufacturing & Engineering Magazine | The Home of Manufacturing Industry News